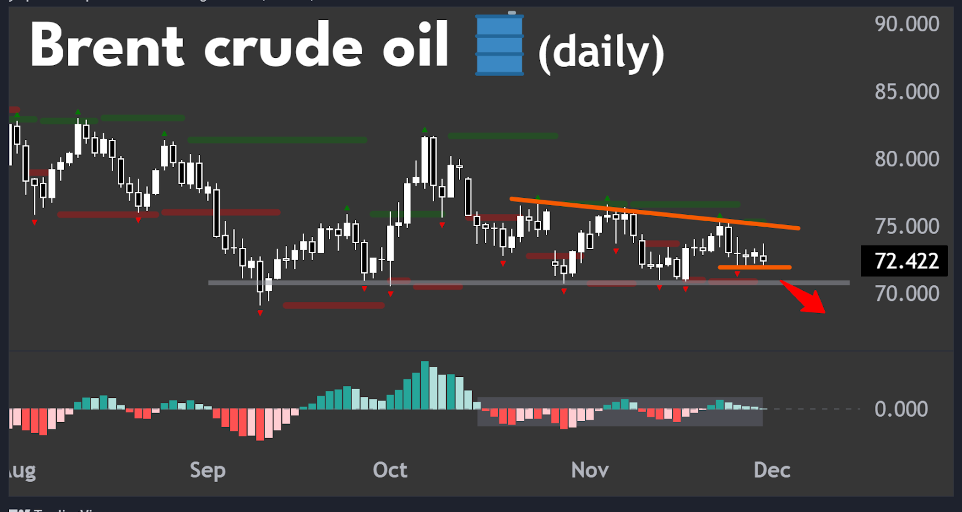

Brent crude (UKO USD)

You know how just as you’re getting into a nice routine, something changes and you have to change your routine?

The same thing happens in markets.

Actually on many levels, markets act in cycles.

Today I’m specifically referencing the regular cycle of market volatility. Markets tend to move from periods of low volatility ➡️ high volatility ➡️ back to low volatility again.

Some of the best setups for a trade happen the moment the market moves from low vol to high vol - often this coincides with a breakout beyond support/resistance.

I’m seeing this very thing in the crude oil market - before the potential breakout.

On the daily chart, price has put in four spinning top candlestick patterns in a row (indicating indecision), and has also been drifting in between the 70 and 75 handles for around 6 weeks.

My team is waiting for the breakdown (or possibly breakout) out of this low volatility trading range into a high volatility trend.

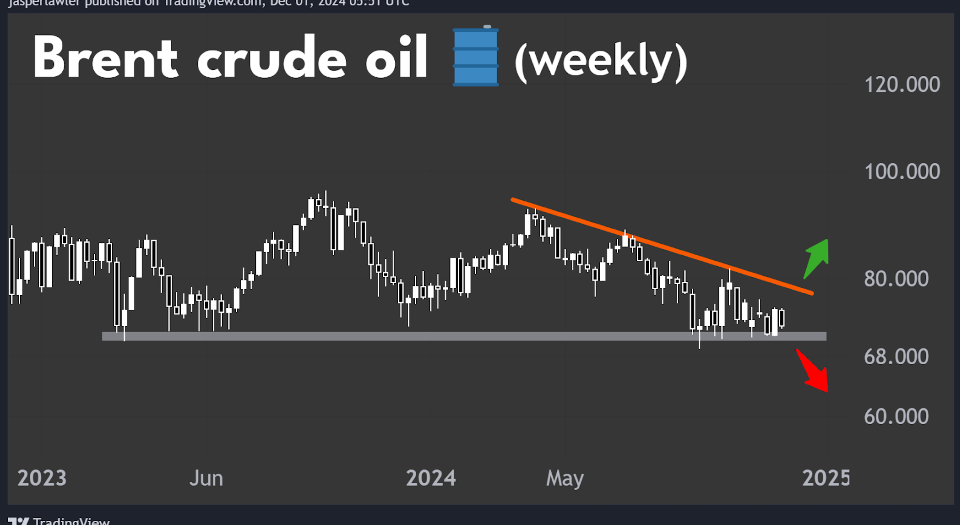

Zooming out to the weekly chart we see that $70 is a huge level for Brent crude oil. It has acted as support for about 18 months - so naturally, if it breaks then it should spark a lot of trading volume - and volatility.

It’s also possible, though we think less likely, that Brent crude breakout above this downtrend line on the weekly chart and re-tests the 80 level.

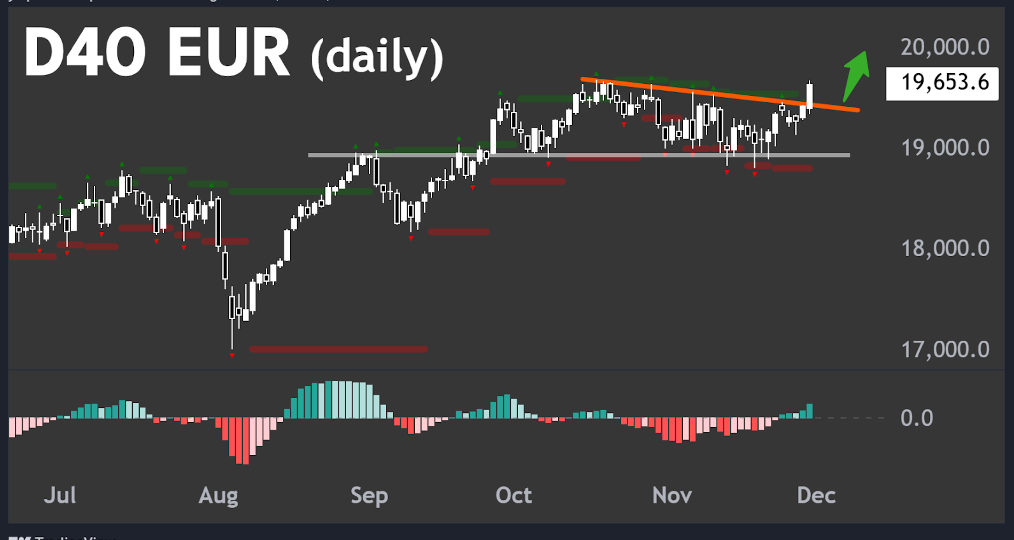

DAX (D40 EUR)

There is actually a very similar volatility setup in Germany’s benchmark stock index - but we think this one is bullish not bearish.

The index is in a clear long term uptrend but has been in a low volatility pullback form its record high reached in October.

Again there have been a series of spinning top candlestick patterns as the market has drifted down from the record high back to the top of the previous trading range.

This is what we want to see in a healthy uptrend. Low volatility moves against the trend (pullbacks) and high volatility impulsive moves in line with the trend.

The trade idea is buy as the low volatility pullback is ending to capture the high volatility trending move higher.

Dropping down to the daily chart we can see the DAX has just broken out from a downtrend line in what was a sort of triangle pattern above the 19000 handle.

While the price remains above this broken trendline, we think the index has room to run higher - perhaps up to (and over) the psychological 20,000 level.

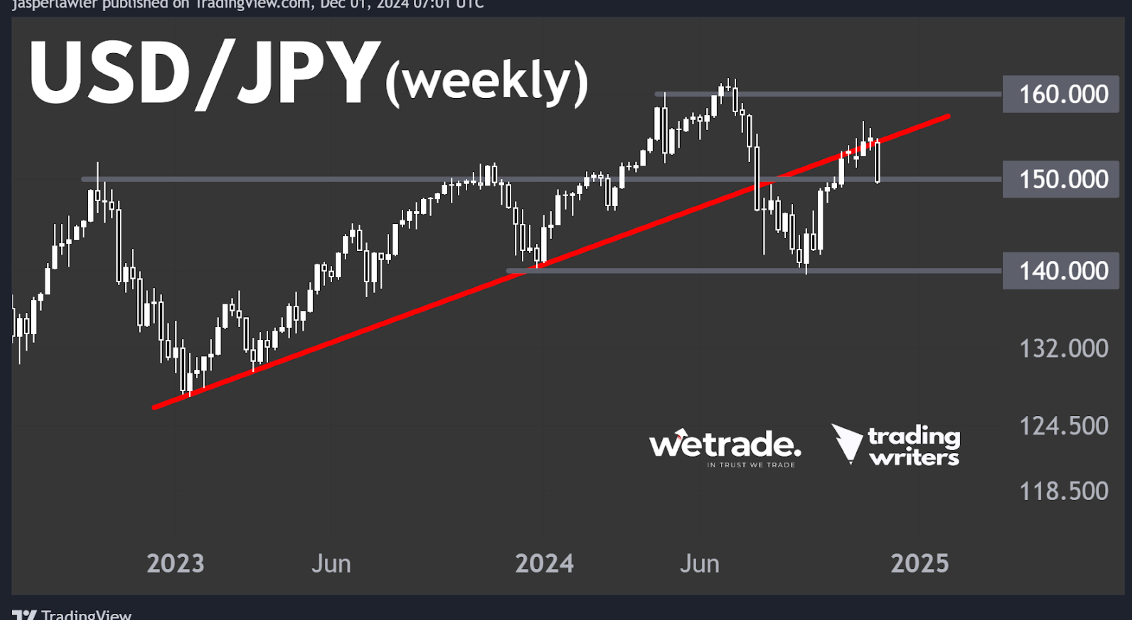

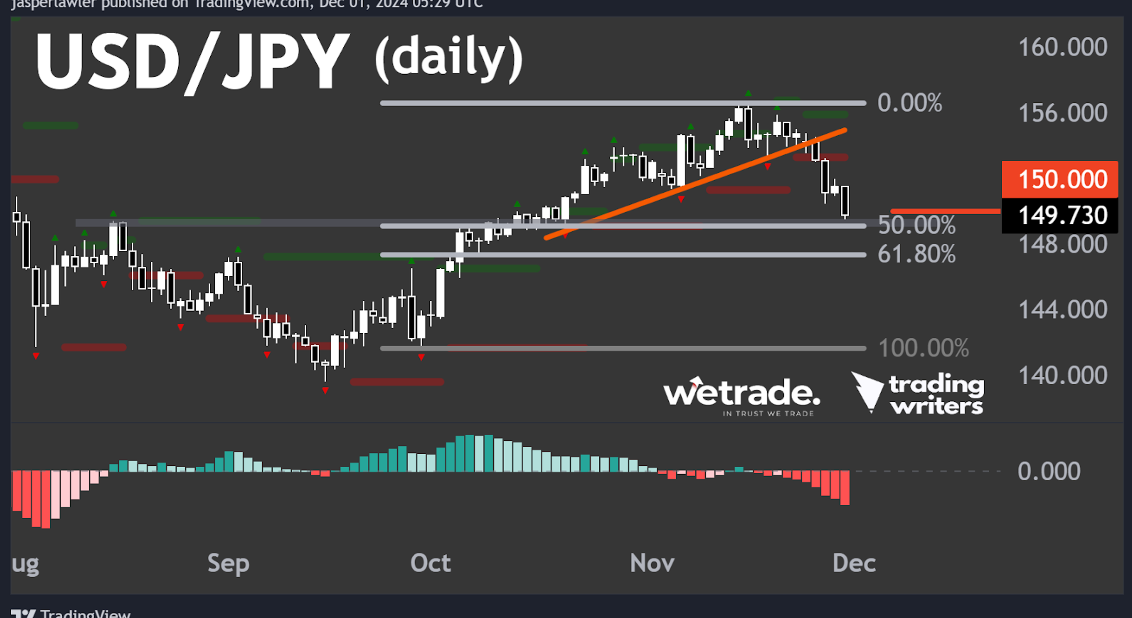

USD/JPY

Never ones to leave out the forex market, we are paying close attention to the large drop in USD/JPY last week - as shown in the weekly candlestick chart below.

This last drop has happened at the retest of the broken uptrend line - suggesting the trendline is holding as resistance after being support.

We foresaw this setup happening (see our analysis in week 45) but we thought it could happen earlier at the 152 level.

Bigger picture, you can see all the major swing points have happened at the ‘00 levels.

We think if the 150 level doesn’t hold as support, then we are more likely to see 140 next instead of 160.

On the daily chart we can see how last week’s sharp drop caused the break below an uptrend line - and has now retraced almost 50% of the previous uptrend.

Any rebound from either the 50% or 61.8% Fibonacci retracement levels could provide a better entry point to ride the possible drop down to 140.

We will be looking for a new upper fractal to form at the end of that possible rebound.

But that’s just how the team and I are seeing things, what do you think?

Send us a message and let us know how you plan to trade these markets.

Trade with WeTrade!

Every position closed is one step closer to unlocking WeTrade Honours privileges and redeeming exclusive rewards.

Start your trading journey here - Register now

Kickstart your trading of the week here - Login Now

Produced by Jasper and the Trading Writers team in collaboration with WeTrade.